End-of-Life Planning: A Guide for Families

A comprehensive guide to help families navigate end-of-life decisions, ensuring dignity and clarity for seniors and peace of mind for loved ones.

End-of-life planning is a compassionate process that helps seniors maintain control over their future care and assets, while reducing stress for caregivers and loved ones. This guide provides step-by-step advice to address legal, medical, and emotional aspects.

1. Discuss Wishes Openly

Initiate honest conversations with your senior loved one about their preferences for medical care, funeral arrangements, and legacy. Choose a comfortable setting and listen without judgment to ensure their voice is heard.

2. Create Advance Directives

Draft legal documents like a living will and healthcare proxy. These specify medical treatment preferences and appoint a trusted person to make decisions if the senior becomes incapacitated.

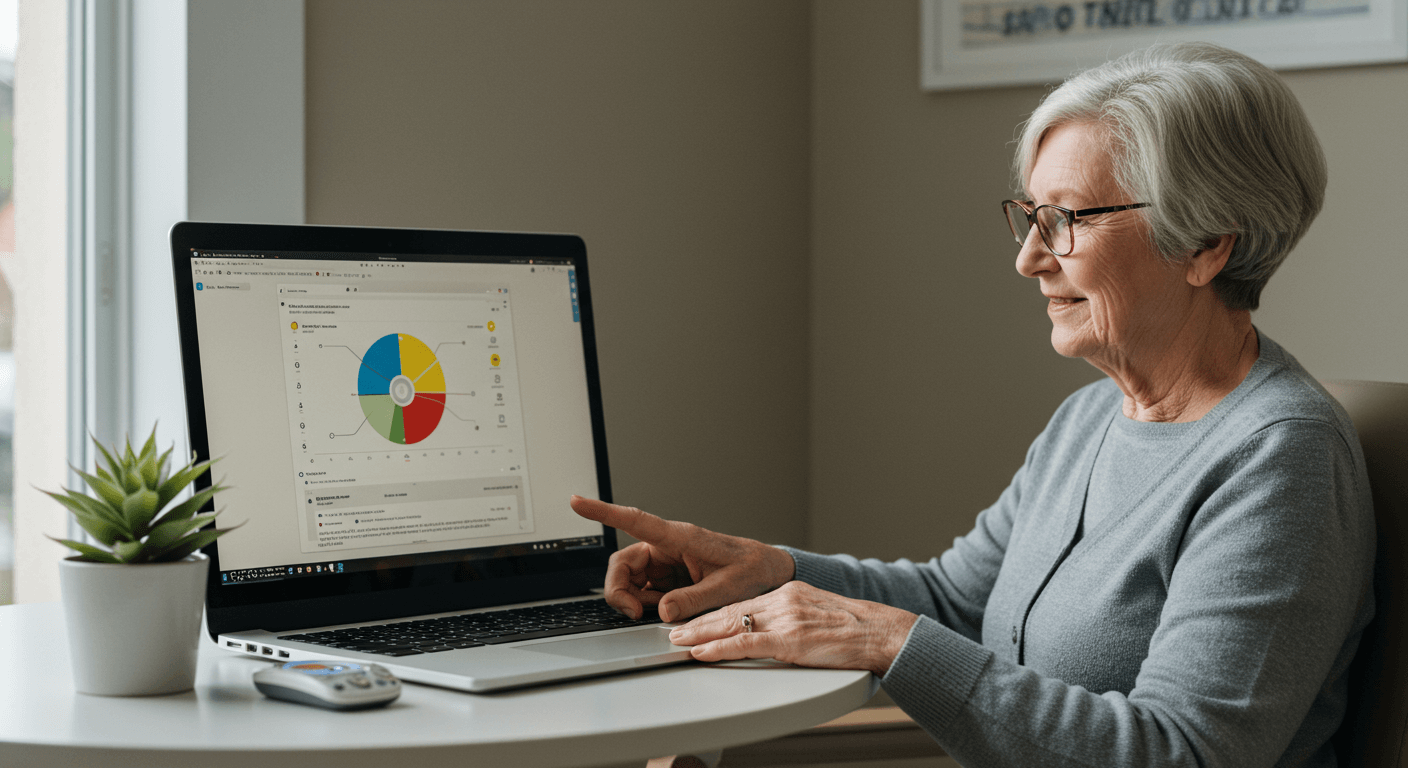

3. Organize Financial Documents

Compile important papers such as wills, trusts, bank accounts, insurance policies, and debt records. Store them securely and share access with authorized family members or advisors.

4. Plan for Care Needs

Research and arrange for potential care options, whether at home, in assisted living, or hospice. Consider costs, location, and quality of care to align with the senior's wishes.

5. Review and Update Regularly

Revisit the plan annually or after major life events. Ensure all documents reflect current desires and laws, and communicate any changes to everyone involved.

The Psychology of End-of-Life Planning

Studies show that proactive end-of-life planning reduces anxiety and depression in seniors and families. It fosters a sense of empowerment and improves the quality of care by ensuring wishes are respected, leading to more peaceful transitions.

Emergency guidance

Sudden Health Crisis

If a senior experiences a medical emergency, having advance directives readily available helps healthcare providers act quickly according to their preferences, avoiding unnecessary treatments and reducing family stress.

Legal Urgencies

In cases of unexpected incapacity without a plan, families may face court interventions. Immediate consultation with an elder law attorney can help expedite decisions and protect the senior's assets and care.

Pro tips

- Involve a neutral third party, like a geriatric care manager, to facilitate discussions and provide expert resources.

- Use online tools or checklists from reputable organizations to ensure no detail is overlooked in the planning process.

Common pitfalls

Avoiding these conversations can lead to family conflicts, financial losses, and medical treatments that contradict the senior's wishes, causing unnecessary distress during an already difficult time.

Recommended reads

You may also like