Financial Assistance Programs for Elder Care

Learn about key financial assistance programs to help cover elder care costs, including government benefits, grants, and support resources for caregivers and seniors.

Navigating financial assistance for elder care can be challenging, but numerous programs exist to help seniors and their families manage costs. This guide covers essential options and how to access them.

1. Research Government Programs

Start by exploring federal and state programs like Medicaid, which often covers long-term care for eligible seniors based on income and assets.

2. Check Veterans Benefits

Veterans and their spouses may qualify for Aid and Attendance benefits, providing monthly payments for care needs through the VA.

3. Apply for Grants

Look into nonprofit grants from organizations like the Alzheimer's Association, which offer financial aid for specific conditions or care situations.

4. Utilize Tax Credits

Take advantage of tax deductions or credits, such as the Dependent Care Credit, which can reduce expenses for caregivers supporting elderly relatives.

5. Seek Local Resources

Contact Area Agencies on Aging for personalized assistance and referrals to local programs that offer subsidies or sliding-scale fees.

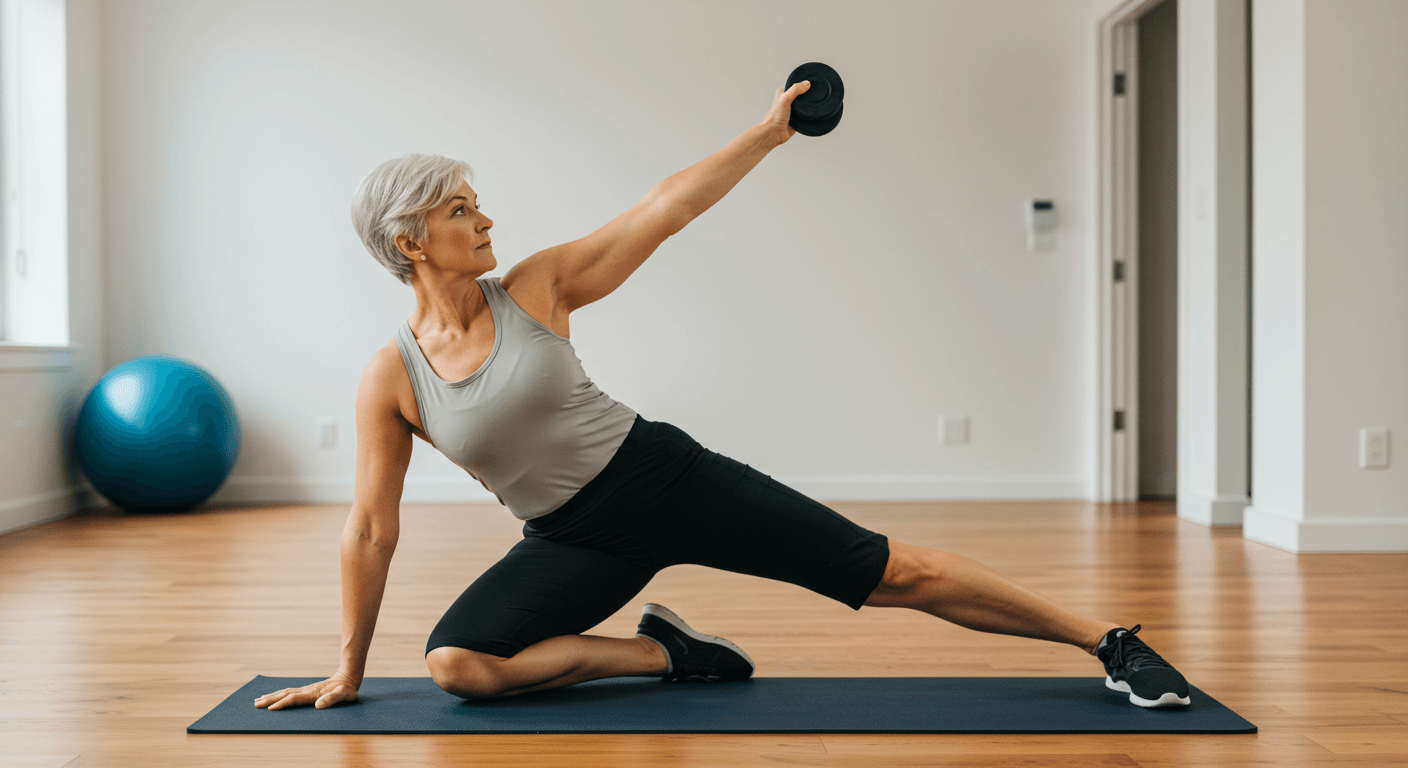

How Financial Aid Impacts Elder Well-Being

Studies show that access to financial assistance reduces stress for seniors and caregivers, leading to better health outcomes and improved quality of life by ensuring consistent care.

Emergency guidance

Immediate Funding Options

In urgent situations, explore emergency grants from charities or short-term loans designed for elder care crises, but review terms carefully to avoid high costs.

Temporary Assistance Programs

Programs like Temporary Assistance for Needy Families (TANF) may provide quick support; contact social services for eligibility and application details.

Pro tips

- Combine multiple programs for maximum coverage, as some benefits can stack to reduce out-of-pocket costs.

- Keep detailed records of all applications and communications to streamline processes and avoid delays.

Common pitfalls

Avoid applying without verifying eligibility first, as rejected claims can cause delays and missed opportunities for other aid.

Recommended reads

You may also like